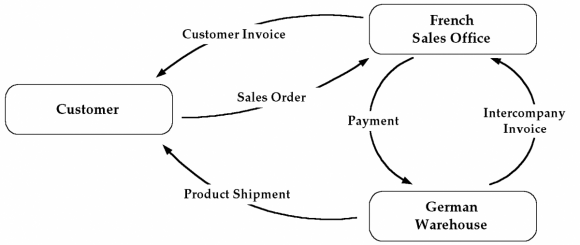

Intercompany invoicing is done when one organization offers products / services to another operating unit. For example, when a customer order is processed through the order cycle and then invoiced, the selling organization records journal entries to accounts receivable, revenue, and as applicable tax and freight. The shipping warehouse records journal entries to its inventory asset and cost of goods sold accounts. When this scenario involves a selling organization in one business unit but a shipping warehouse in a different business unit, additional accounting must take place. The shipping organization needs to bill the selling organization at transfer price, and the selling organization needs to make the corresponding payment.

Note that intercompany invoicing is possible only between two operating units. You cannot invoice between two inventory orgs if they belong to the same operating unit.The intercompany AR invoice is the transaction used by Oracle to record intercompany receivable accounting for the shipping organization: debiting intercompany AR (at transfer price), tax, and freight and crediting intercompany revenue.

The intercompany AP invoice is the transaction used by Oracle to record the payable accounting for the selling organization: debiting intercompany COGS (at transfer price) and freight and crediting the intercompany payable account. Ideally, these transactions should happen automatically and as soon as possible after the shipment takes place. This can be done using the intercompany invoicing process within Oracle applications.

Oracle supports intercompany invoicing when:

- Shipping operating unit is different from selling operating unit and

- Receiving operating unit is different from procuring operating unit.

Basic Business Needs

Oracle Applications provides you with the features you need to satisfy the following basic business needs.

- Enter sales orders from one operating unit and assign a shipping warehouse under a different operating unit.

- Automatically create intercompany payable and receivable invoices to record intercompany revenue, payables and receivables.

- Eliminate intercompany profit in the general ledger.

Major Features

Automatic Intercompany Sales Recognition

You can assign a shipping warehouse under a different operating unit to a sales order. The system automatically records an intercompany sale between the shipping organization and the selling organization by generating intercompany invoices.

Segregating Trade and Intercompany COGS and Revenue

You can define different accounts for Trade and Intercompany COGS and Sales Revenue to eliminate intercompany profits’ Transfer Pricing. You can establish your transfer pricing in intercompany invoices through Oracle Order Management and Shipping Execution’s price lists.

Extensible Architecture

At key event points in the programs, stored procedure callbacks have been installed, including invoice and invoice line creations, and the transfer pricing algorithm. You can insert PL/SQL code to append or replace existing program logic to fulfill your specific business requirements.

Leave a Reply

Want to join the discussion?Feel free to contribute!