1. For a single process flow (one procure-to-pay cycle or order-to-cash cycle), you can model Oracle to generate intercompany invoices between two or more operating units. The building block of intercompany invoicing is the setup of intercompany transaction flow.

The intercompany transaction flow establishes the physical flow of goods and financial flow relationship between two operating units. The intercompany transaction flow establishes the relationship between one operating unit (known as Start Operating Unit) and another operating unit (known as End Operating Unit) about the actual movement of goods. Similarly, it also establishes the invoicing relationship between Start Operating Unit and End Operating Unit.

2. Intercompany transaction flow is of two types – shipping flow and procuring flow. You need to setup intercompany transaction flow of type shipping when selling operating unit is different from shipping operating unit. You need to setup intercompany transaction flow of type procuring when buying operating unit is different from receiving operating unit.

3.1 By enabling advanced accounting for an intercompany transaction flow, you would be able to generate multiple intercompany invoices between different operating units for the same physical movement of goods.

Oracle supports intercompany invoicing for both shipping and procuring flows. However, you need to use the ‘Advanced Accounting’ option for enabling intercompany invoicing for procuring flow even if it involves only two operating units. If you do not enable ‘Advanced Accounting’ option at the intercompany transaction header, then no logical transactions will be generated and no intermediate nodes can be defined

3.2 You need to define intercompany relations between each pair of operating units in the intercompany transaction flow. When advanced accounting is enabled for an intercompany transaction flow, you will be able to define multiple intercompany relationships between different operating units. If advanced accounting is set to No, then an intercompany transaction flow can have only one intercompany relation (it is between start operating unit and end operating unit).

At each pair of intercompany relationship, you will define the intercompany accounts, and currency code to be used on AR and AP invoices.

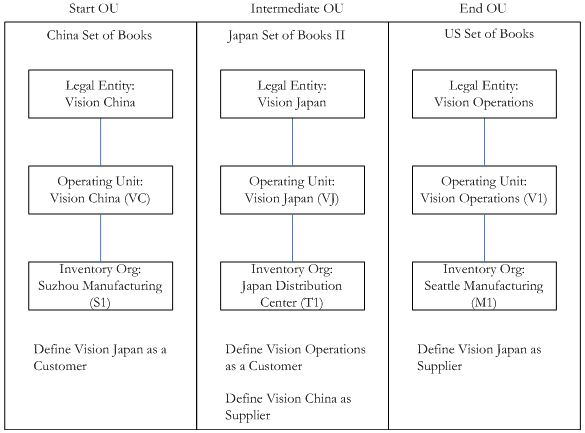

Note that in Figure 3.1 – Intercompany Transaction Flow, physical goods never flow through intermediate operating unit. Oracle creates ‘Logical Material Transactions’ between the operating units, based on which intercompany invoices between multiple operating units are raised.

3.3 No logical transactions will be created when you do not choose ‘Advanced Accounting’. For example, the transactions in Figure 4 can be broken down as depicted in Figure 6.

Logical transactions are useful to record financial transactions between two operating units without physical movement of goods. For example, in Figure 3.2 – Logical Material Flow, Vision Japan is an intermediate operating unit through which no physical goods flow. However, it is a financial intermediate node, which is involved in intercompany invoice flow. To facilitate accounting in the intermediate OUs, logical intercompany receipt and issue transactions are created. Similarly, logical receipt and logical sales order issue transactions are created for those receipts and issues that are not accompanied with physical receipt and issue of goods.

3.4 Advanced Accounting’ option is not available for internal requisitions – internal sales order business flow. Though you can set the ‘Advanced Accounting’ flag at Intercompany Transaction Flow header to ‘Yes’, system ignores the flag and does not generate any logical transactions. This means you cannot have an intermediate financial node in the intercompany transaction flow. Also, you cannot have intercompany invoicing for internal sales order with direct transfer (in shipping network between the inventory organizations) as an option. You have an flexibility to switch off intercompany invoicing for internal sales orders by setting the profile ‘INV: Intercompany Invoice for Internal Orders’ to No.

Intercompany invoicing is possible for inter-org transfers of type ‘In-transit’ only through ‘Internal sales Orders’. No intercompany invoicing is possible if you perform org transfers between two inventory orgs belonging two different operating units without ‘internal sales Orders’. Also note that intercompany invoice cannot be raised for inter-org transfers of type ‘Direct Transfer’ through Internal sales Orders.

Customer and Supplier relationship

Intercompany invoicing is widely used in multinational organizations. Sometimes you will find that these companies engage in a customer – supplier relationship.

For example, in above Figure you need to define Vision Japan as a customer in Vision China operating unit. Similarly, Vision China should be defined as a supplier in Vision Japan. When you define an intercompany relationship between Vision Japan and Vision China, actually you are establishing an internal customer and supplier relationship. Similar is the case for every intercompany relationship in an intercompany transaction flow. However, at present intercompany invoicing does not support any sales credit check.

Nice article share more interesting post i am waiting ..

Oracle Advance Procurement

Your post is certainly one of the best source of valuable information every reader must follow.

Oracle Advance Procurement