Procure to Pay Lifecycle is one of the important Process in Oracle Applications. Procure to Pay means

Procuring Raw Materials required to manufacture the final or finished Goods from a Supplier to

Paying the Supplier from whom the material was purchased. But this process is not just two steps. It involves many steps. Let’s see the steps and Oracle Application involved in performing those steps.

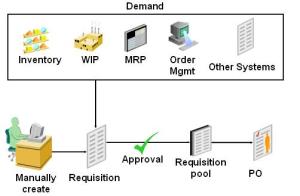

1.Creation Of Purchase Requisition

Requisition is nothing but a formal request to buy something. Requisitions represent the demand for any goods or services that an organization needs.

Requisitions for goods and services:

- Are generated by applications including Inventory, Work in Process (WIP), Material Requirements Planning (MRP) and Order Management.

- May be entered manually through Purchasing windows.

- May be entered using iProcurement.

- May be imported from external systems.

There are two types of Requisitions

1] Internal Requisition – Basically used when there is a Requirement from One Inventory Organization to the Other Inventory Organization (Inter- Organization Transfer)

2] Purchase Requisition – Basically used when there is a Requirement to be fulfilled by External Sources i.e. Suppliers, Requirement from MRP, Requirement from WIP, Requirement from Sales Order etc.

With Oracle Purchasing module, you can create, edit, and review requisition information on-line. Then the Requisitions went for approvals from proper authorities.

2. Creation of Purchase Order

Based on the Purchase Requisition and its approval next we have to create a Purchase order to buy the item.

Purchasing supports four types of purchase orders:

1] Standard: Create standard purchase orders for one-time purchases of various items. You create standard purchase orders when you know the details of the goods or services you require, estimated costs, quantities, delivery schedules, and accounting distributions.

2] Blanket: Create blanket purchase agreements when you know the detail of the goods or services you plan to buy from a specific supplier in a period, but you do not yet know the detail of your delivery schedules.

3] Contract: Create contract purchase agreements with your suppliers to agree on specific terms and conditions without indicating the goods and services that you will be purchasing.

4] Planned: A planned purchase order is a long-term agreement committing to buy items or services from a single source. You must specify tentative delivery schedules and all details for goods or services that you want to buy, including charge account, quantities, and estimated cost.

Once purchase orders are created, they may be submitted for approval. The approval process checks to see if the submitter has sufficient authority to approve the purchase order. Once the document is approved, it may be sent to your supplier using a variety of methods including: printed document, EDI, fax, e-mail, iSupplier Portal and XML. Once the purchase order or release is sent to your supplier, they are authorized to ship goods at the times and to the locations that have been agreed upon.

3. Receipt of Material

After receiving the PO, the supplier will send the items.

Purchasing lets you control the items you order through receiving, inspection, transfer, and internal delivery. You can use these features to control the quantity, quality, and internal delivery of the items you receive.

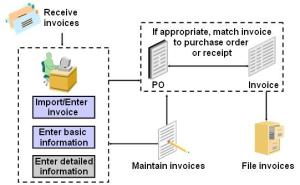

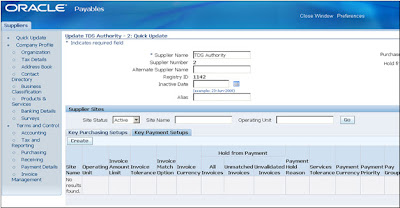

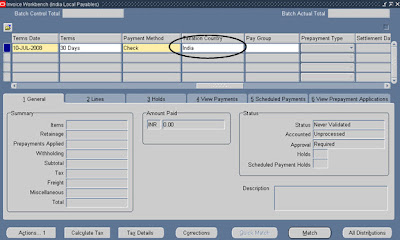

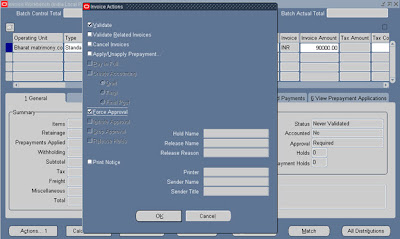

4. Creation of Payables Invoice

Once you’ve received goods or service from your supplier, you’ll also receive an invoice. Using Payables you can record invoices in a number of different ways.

With Payables you can:

- Import/Enter invoices manually, either individually or in batches.

- Use Quick Invoices for rapid, high-volume entry of standard invoices and credit memos that are not complex and do not require extensive online validation.

- Automate invoice creation for periodic invoices using the Recurring Invoice functionality.

- Use iExpenses to enter employee expense reports using a web browser.

- Import EDI invoices processed with the e-Commerce Gateway.

- Import XML invoices.

- Match invoices to purchase orders or receipts to ensure you only pay what you’re supposed to be paying for.

5. Payment to Supplier

Once invoices are validated, they can be paid. Payables integrates with Oracle Payments, the E-Business Suite payment engine, to handle every form of payment, including checks, manual payments, wire transfers, EDI payments, bank drafts, and electronic funds transfers. Payables also integrates with Oracle Cash Management to support automatic or manual reconciliation of your payments with bank statements sent by the bank.

This is how the P2P Cycle occurs in Oracle Apps.

Recent Comments