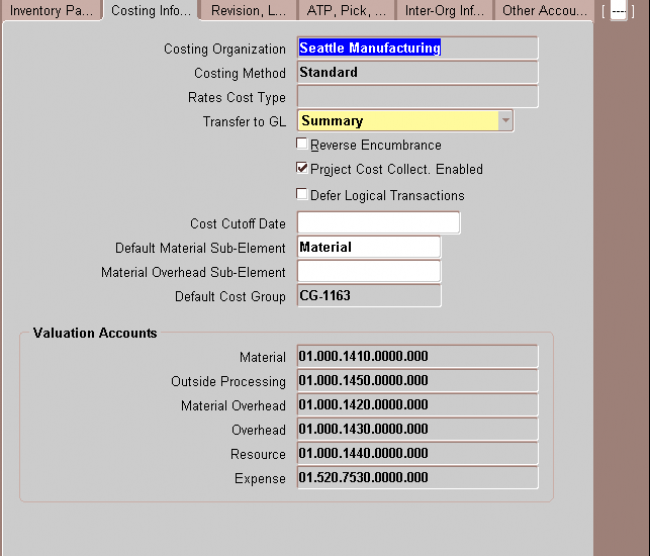

Defining Costing Information

1. Costing Organization

2. Costing Method

3. Transfer to GL Indicate whether all transactions are posted in detail to the general ledger.

Caution: Transferring detail transaction distributions to the general ledger increases general ledger posting times due to the number of records created.

4. Reverse Encumbrance Indicate whether to reverse encumbrance entry upon receipt in inventory.

You normally select this option if you use encumbrances with Oracle Purchasing.

5. Optionally, enter a Cost Cutoff Date

If you leave this field blank, all available transactions will be costed,as usual. If you enter a date, all transactions prior to this date will be costed. All transactions on or later than this date will not be costed.

For inter–organization transfers, a standard costing, receiving organization will not cost a receipt if the sending organization did not already cost the transaction.

The default time is the first instant of the date. You can optionally choose another time.

The standard cost update process can be performed on the cost cutoff date. You can restart cost processing by changing the cutoff date to blank, or a future date.

6. Default Material Sub elementFor standard costing, select a material sub–element that this organization uses as a default when you define item costs. For average costing, the default material sub–element you select can be used for cost collection when Project Cost Collection Enabled is set.

7. Material Over head Sub elementOptionally, select a Default Material Overhead Sub–Element from the list of values. During the Supply Chain Rollup process, when costs are merged from another organization, markup and shipping costs will use this value.

The supply chain cost rollup will complete successfully, regardless of whether this field is populated. If the Cost Rollup identifies an organization with a default material overhead sub–element not set up, a corresponding warning message will be printed in the log file.

8. Default Cost GroupIndicate the default cost group for the organization. This will default into the Default Cost Group field for each subinventory. If the WMS cost group rules engine fails to find a cost group, this cost group will be used.

9. Valuation Accounts

You choose a default valuation account when you define organization parameters. Under standard costing, these accounts are defaulted when you define subinventories and can be overridden. Under average costing, these accounts (except for Expense) are used for subinventory transactions and cannot be updated. For a detailed discussion of cost

elements.

Material An asset account that tracks material cost. For average costing, this account holds your inventory

and intransit values. Once you perform transactions, you cannot change this account.

Material Overhead An asset account that tracks material overhead cost.

Resource An asset account that tracks resource cost.

Overhead An asset account that tracks resource and outside processing overheads.

Outside processing An asset account that tracks outside processing cost.

Expense The expense account used when tracking a non–asset item.

Leave a Reply

Want to join the discussion?Feel free to contribute!