Bank model in Cash Management – R12

-

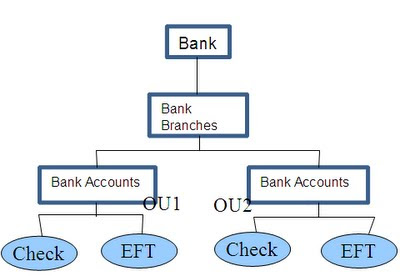

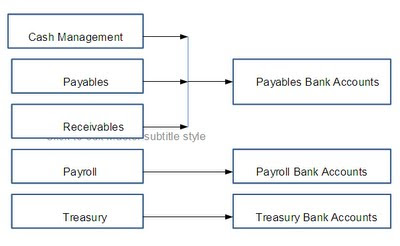

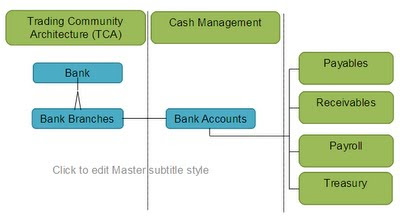

There is a central place to define internal bank accounts. So with centralized user interface, users can reduce the number of access points to manage bank accounts

-

With the help of Multi-Org Access Control, we can explicitly grant account access to multiple operating units/functions and users, which improves the visibility and control of bank accounts

-

A single Legal Entity is granted ownership of each internal bank account and One or more Organizations are granted usage rights. So, a single bank statement can be reconciled across multiple Operating Units, which helps to simplify reconciliation process.

-

Reconciliation options can now be defined at the bank account level, which provides more flexibility and control to the reconciliation process.

CE_BANK_ACCOUNTS Contains Legal Entity Level bank account information. Each bank

CE_BANK_ACCT_USES_ALL Stores Operating Unit level bank account use information.

CE_PAYMENT_DOCUMENTS Stores payment Documents to be used for Printed type Payments

CE_BANK_BRANCHES_V View: Bank/Branches Info

CE_BANK_ACCT_USES_OU_V View: Internal Bank Account Uses Info

AP_BANK_BRANCHES

AP_BANK_ACCOUNTS_ALL

AP_BANK_ACCOUNTS_USES_ALL

1. Navigate to Suppliers -> Entry.

2. Query or create your supplier.

3. Click on Banking Details and then choose Create.

After creating the bank account, we can assign the bank account to the supplier site.

Leave a Reply

Want to join the discussion?Feel free to contribute!