- Oracle Database

- Oracle E-Business Suite

- Oracle Enterprise 2.0

- Oracle Fusion Middleware

- Oracle Service-Oriented Architecture (SOA)

- Oracle Business Intelligence – Applications

- Oracle Business Intelligence – Technology

- Oracle Data Warehousing

- Governance, Risk, & Compliance (GRC)

- Identity Management (IdM)

- Oracle Transportation Management

- Performance Management – Business Intelligence and Analytics

- JD Edwards EnterpriseOne

- PeopleSoft Enterprise

- Siebel

Accounts receivable is an asset account in the general ledger that documents money owed to a business by customers who have purchases goods or services on credit.

Accounts receivable can be contrasted with accounts payable, a liability account in the GL that documents money the business owes for the purchase of goods or services.

Accounts receivable, accounts payable and payroll are usually listed as the top three mission-critical business processes in a disaster recovery plan .

Receivables Workbenches:

Oracle Receivables provides four integrated workbenches that you can use to perform most of your day–to–day Accounts Receivable operations. You can use the Receipts Workbench to perform most of

your receipt–related tasks and the Transactions Workbench to process your invoices, debit memos, credit memos, on–account credits, chargebacks, and adjustments. The Collections Workbench lets you review customer accounts and perform collection activities such as recording customer calls and printing dunning letters. The Bills Receivable Workbench lets you create, update, remit, and manage your bills receivable.

Each workbench lets you find critical information in a flexible way, see the results in your defined format, and selectively take appropriate action. For example, in the Transactions Workbench, you can query transactions based on the bill–to or ship–to customer, currency, transaction number, or General Ledger date. You can then review financial, application, and installment information, perform adjustments, create a credit memo, or complete the transaction. All of the windows you need are accessible from just one window, so you can

query a transaction once, then perform several operations without having to find it again.

Receivables Setups in R12:

Overview of Setting Up:

During setup, you define business fundamentals such as the activities you process and their accounting distributions, your accounting structure, and various control features. Setup is also the time to define

comprehensive defaults that Receivables uses to make data entry more efficient and accurate. In addition, setup lets you customize Receivables to employ the policies and procedures that you use in your business.

You can set up Receivables a number of different ways. The following graphic shows the most complete setup scenario. If you use the Oracle Applications Multiple Organization Support feature to use multiple sets of books for one Receivables installation, please refer to the Multiple Organizations in Oracle Applications manual before proceeding. If you plan to use Oracle Cash Management with Oracle Receivables, additional setup steps are required.

Note: If you plan to use Multiple Reporting Currencies (MRC) with Receivables, additional setup steps are required. For more information, refer to the Multiple Reporting Currencies in Oracle Applications manual.

Related Product Setup Steps:

The following steps may need to be performed to implement Oracle Receivables. These steps are discussed in detail in the Setting Up sections of other Oracle product user guides.

Set Up Underlying Oracle Applications Technology

The Implementation Wizard guides you through the entire Oracle Applications setup, including system administration. However, if you do not use the Wizard, you need to complete several other setup steps, including:

• performing system–wide setup tasks such as configuring concurrent managers and printers

• managing data security, which includes setting up responsibilities to allow access to a specific set of business data and complete a specific set of transactions, and assigning individual users to one or more of these responsibilities.

• setting up Oracle Workflow

General Ledger Setup Steps:

The following table lists steps and a reference to their location within the Applications Implementation Wizard (AIW).

- Define Chart of Accounts

- Define Currencies

- Define Calendars

- Define Calendar Period Types

- Define Ledger

- Assign Ledger to a Responsibility

Define Chart of Accounts:

Define Segments:

Navigation: General Ledger –> Setups –> Flexfields –> Key –> Segments.

Query With Accounting Flexfield and click on New.

Give your coa name and save.

Click on Segments.

Enter your segments names.

Navigation: General Ledger –> Setups –> Flexfields –> Key –>Values.

Enter the below information and click on find button.

Enter the company values names and save your work.

Like wish define values for all reaming segments.

Define Currencies:

Navigation: General Ledger –> Setup –> Currencies –> Define.

Enter information and save.

Define Calendar Period Types:

Navigation: Setup –> Financials –> Calendars –> Types.

Enter the information and save.

Define Calendar:

Navigation: Setup –> Financials –> Calendars –> Accounting.

Save.

Define Ledger :

See this post for how to define Ledger in R12.

Assign Ledger to a Responsibility:

Navigation: System Administrator –> Profile –> Systems.

Click on find.

Assign Ledger to GL Responsibility.

Save.

Oracle Inventory Setup Steps:

- Define Operating Unit.

- Define Inventory Organizations

- Define Items

Define Operating Unit:

Define Inventory Organization:

Navigation: Inventory –> Setup –> Organizations –> Organizations.

Click on New.

Enter information in the required fields.

Save your work and click on othres.

click on Accounting information.

Enter the required information and save.

Click on Others and select the inventory information.

Under Inventory Parameters tab enter the following information.

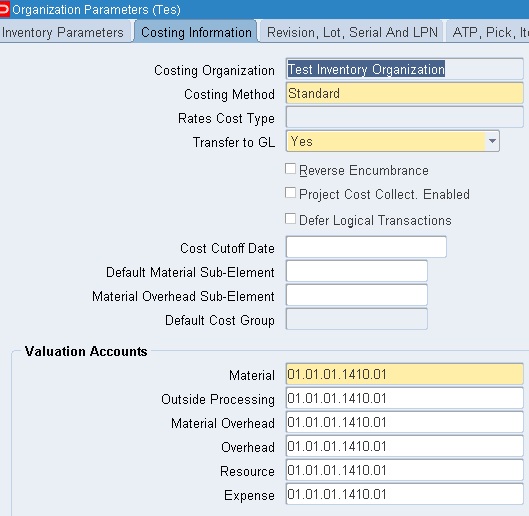

Under Costing Information tab enter the following information.

Under the other accounts tab enter the required information.

Save your work.

- Define System Options

- Define Transaction Flexfield Structure

- Define Sales Tax Location Flexfield Structure

- Define AutoCash Rule Sets

- Define Receivables Lookups

- Define Invoice Line Ordering Rules

- Define Grouping Rules

- Define Application Rule Sets

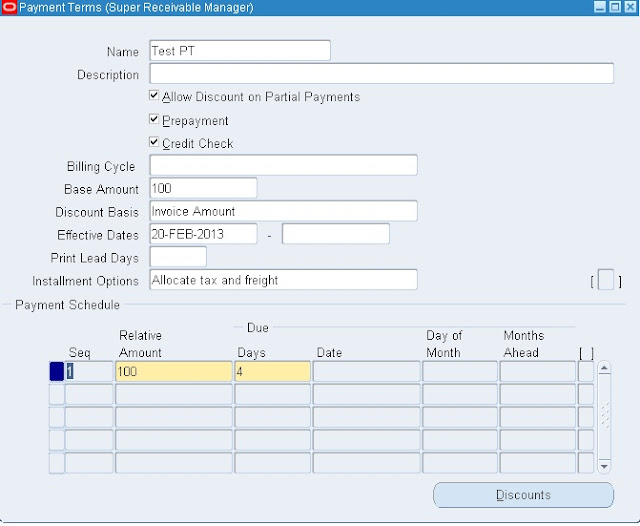

- Define Payment Terms

- Define AutoAccounting

- Open or Close Accounting Periods

- Define Transaction Types

- Define Transaction Sources

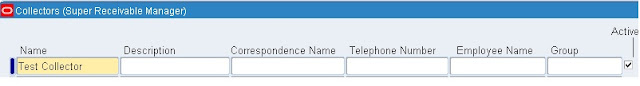

- Define Collectors

- Define Approval Limits

- Define Remittance Banks

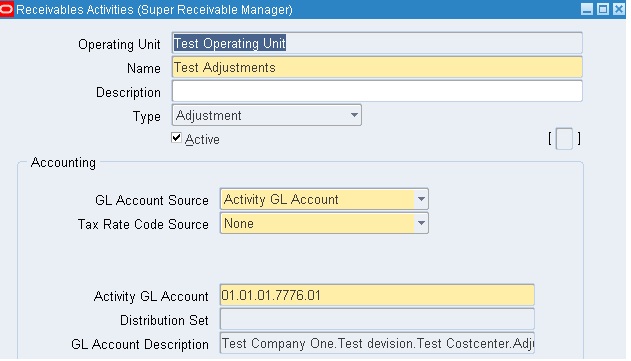

- Define Receivables Activities

- Define Receipt Classes

- Define Receipt Sources

- Define Payment Methods

- Define Statement Cycles

- Define System Profile Options

- Define Salespersons

- Define Customer Profile Classes

- Define Customers

- Define Remit–To Addresses

System options also control how Receivables calculates tax on your transactions. You must specify a tax method, choose a Location Flexfield Structure, indicate whether to compound tax, select the address validation to use, and define tax defaults and rounding options. As you can set up your system to calculate Sales Tax, Value Added Tax, or Canadian Tax, we recommend that you carefully review the appropriate implementing tax essay before defining your system options.

There are four types of transaction flexfields:

• Line Transaction Flexfield

• Reference Transaction Flexfield

• Link–To Transaction Flexfield

• Invoice Transaction Flexfield

transaction line. AutoInvoice always uses the Line Transaction Flexfield structure for both the Link–to and Reference information when importing invoices. You must explicitly define the Link–to, Reference,

and Invoice Transaction Flexfield structures only if this information is to be displayed on a custom window.

Receivables gives you the option of displaying Invoice Transaction Flexfield information in the reference column of invoice lists of values.

order number for imported invoices when using an invoice list of values, you must assign the transaction flexfield segment that holds the order number to the AR: Transaction Flexfield QuickPick Attribute

profile option. The order number will now display in the reference column of invoice lists of values.

Reference Transaction Flexfields have the same structure as the Line Transaction Flexfields.

Transactions 4 – 235 Reference Transaction Flexfields are used to apply a credit memo to an invoice or associate an invoice to a specific commitment.

Create a new flexfield with a similar structure as the Line Transaction Flexfield, but only include header level segments. For example, if the Line Transaction Flexfield structure has four segments and the last two segments contain line level information, define your Invoice Transaction Flexfield using the first two segments only. Segments included in the Invoice Transaction Flexfield should be included in the AutoInvoice grouping rules.

• Country

• State and City

• Province and City

• City

• Province

• State, County and City

your customer addresses.

You can confirm that the required segments are enabled by navigating to the Segments Summary window. Navigate back to the Key Flexfield Segments window to freeze your flexfield structure by checking the

Freeze Flexfield Definition check box and then compiling the flexfield.

account, tax, freight, creation sign, posting, and receivables information. Receivables provides two predefined transaction types: Invoice and Credit Memo.

Define Approval Limits:

Define approval limits to determine whether a Receivables user can approve adjustments or credit memo requests. You define approval limits by document type, dollar amount, reason code, and currency.

Approval limits affect the Adjustments, Submit AutoAdjustments, and Approve Adjustments windows as well as the Credit Memo Request Workflow.

Navigation: Receivables –> Setup –> Transactions –> Approval Limits.

Define Remittance Banks:

Proceed to the next step if you already defined your remittance banks in Oracle Payables. Define all of the banks and bank accounts you use to remit your payments. You can define as many banks and bank accounts as you need and define multiple currency bank accounts to accept payments in more than one currency.

Define Receivables Activities

Define Receivables Activities to provide default accounting information when you create adjustments, discounts, finance charges, miscellaneous cash transactions, and bills receivable. Receivables also uses Receivables Activities to account for tax if you calculate tax on these activities.

Navigation: Receivables –> Setup –> Receipts –> Receivable Activities.

Like wise we should define reaming receivable actives also.

Define Receipt Classes:

Define receipt classes to specify whether receipts are created manually or automatically. For manual receipts, you can specify whether to automatically remit it to the bank and/or clear your accounts. For automatic receipts, you can specify a remittance and clearance method, and whether receipts using this class require confirmation.

Navigation: Receivables –> Setup –> Receipts –> Receipts Class.

Click on Bank accounts.

Enter information in respective fields.

Save your work.

Define Payment Method:

Define the payment methods to account for your receipt entries and applications and to determine a customer’s remittance bank information. When defining payment methods, you must enter a receipt class, remittance bank information, and the accounts associated with your payment receivables type. You can also specify accounts for confirmation, remittance, factoring, bank charges, and short–term debt.

Navigation: Receivables –> Setup –> Receipts –> Receipts Class.

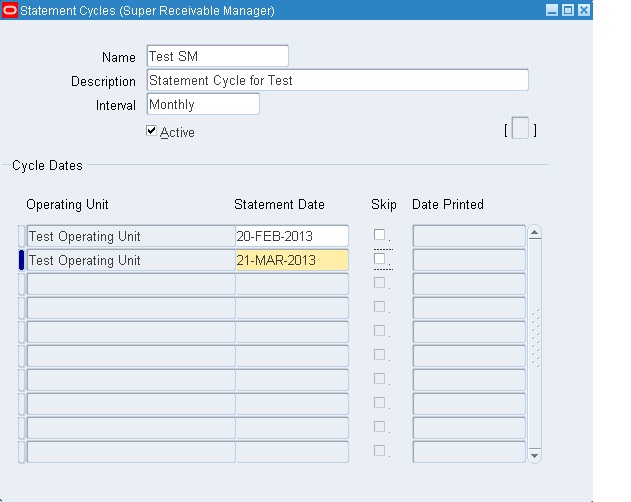

Define Statement Cycles:

Define statement cycles to control when you create customer statements. You assign statement cycles to customers in the Customer Profile Classes window.

Navigation: Receivables –> Setup –> Print –> Statement Cycle.

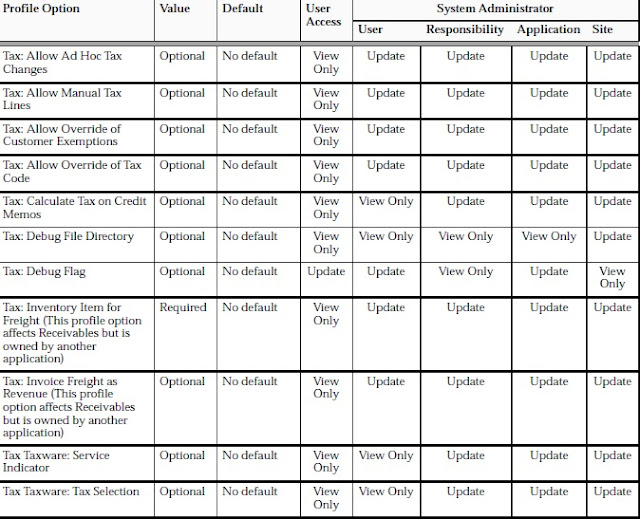

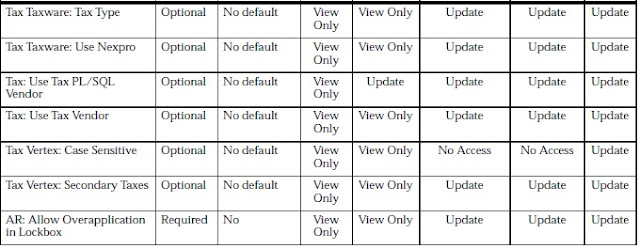

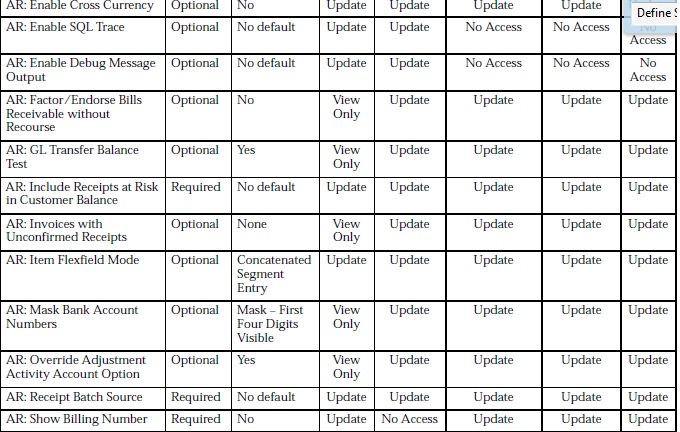

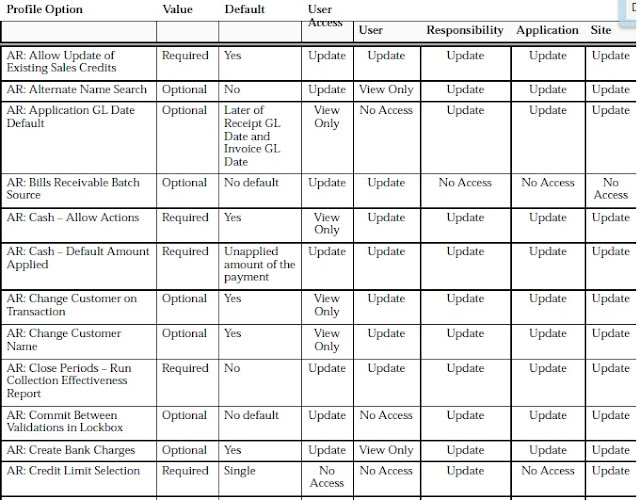

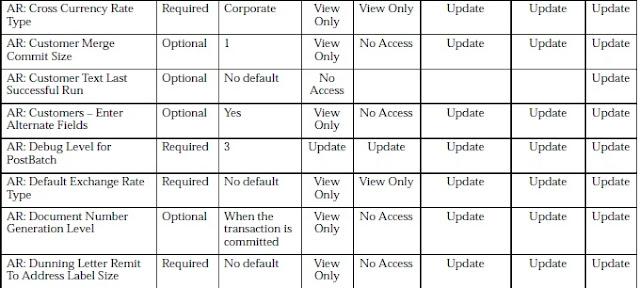

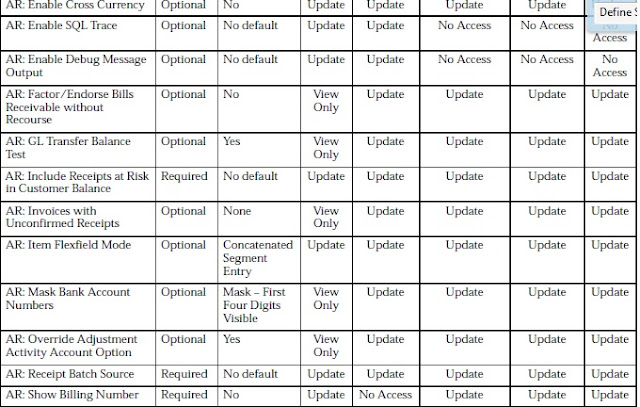

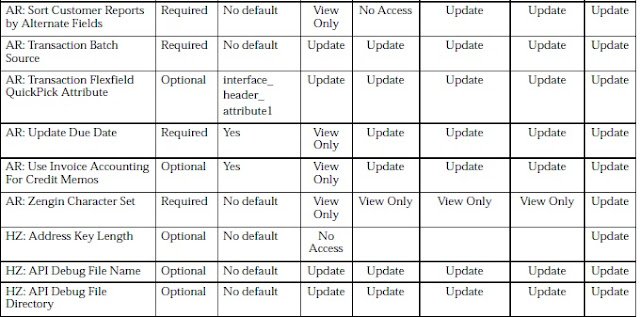

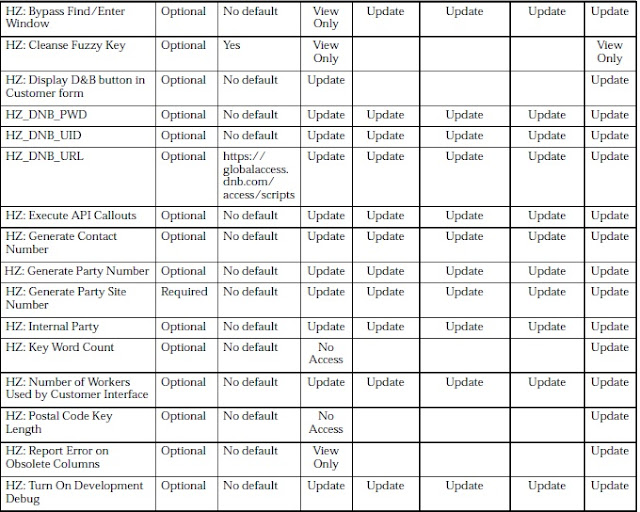

Define profile options:

Define profile options to provide default values for some Receivables operations, specify how Receivables processes data, and control which actions users can perform.

Navigation: Administrator –> Profile –> Systems.

During your implementation, you set a value for each Receivables user profile option to specify how Receivables controls access to and processes data. Receivables lets you govern the behavior of many of

the windows that use profile options.

Profile options can be set at the following levels:

• Site: This is the lowest profile level. Site level profile option values affect the way all applications run at a given site.

• Application: These profile option values affect the way a given application runs.

• Responsibility: These profile option values affect the way applications run for all users of a given responsibility.

• User: These profile option values affect the way applications run for a specific application user. The values you enter for options at the User level supersede the values that your system administrator has entered for you for these options.

Each of these user profile options affect the behavior of Receivables in different contexts. In Receivables, operations that profile options can affect include receipt application, the entry of adjustments, the creation

and remittance of automatic receipts and taxes, and posting to your general ledger.

You may also have additional user profile options on your system that are specific to applications other than Receivables.

To change profile options at the Site, Application, or Responsibility level, choose the System Administrator responsibility, then navigate to the Personal Profile Values window. Query the Profile Name field to

display the profile options with their current settings, make your changes, then save your work. You can change profile options at the user level in the Personal Profile Values window. To do this, navigate to the Personal Profile Values window, query the profile option to change, enter a new User Value, then save your work. Generally, your system administrator sets and updates profile values at each level.

Attention: For any changes that you make to profile options to take effect, you must either exit, and then reenter Receivables, or switch responsibilities.

Define Salespersons:

Define salespersons to allocate sales credits to invoices, debit memos, and commitments. If you do not want to assign sales credits for a transaction, you can enter No Sales Credit. If AutoAccounting depends on salesperson, Receivables uses the general ledger accounts that you enter for each salesperson along with your AutoAccounting rules to determine the default revenue, freight, and receivable accounts for transactions.

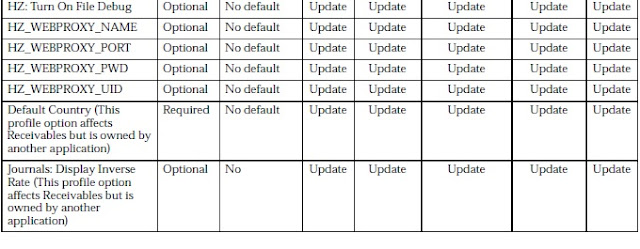

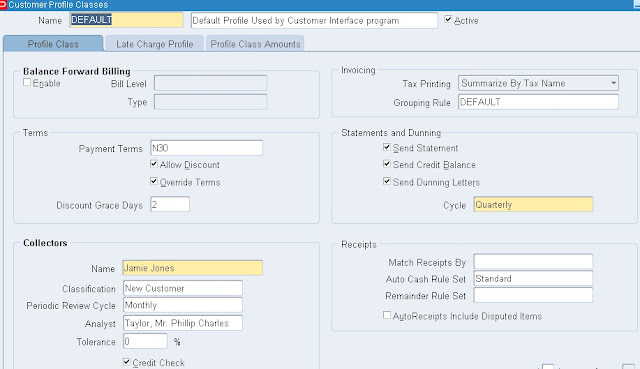

Define Customer Profile Classes:

Define customer profile classes to categorize customers based on credit, payment terms, statement cycle, automatic receipt, finance charge, dunning, and invoicing information. When you initially set up your customers, you assign each customer to a profile class. To customize the profile class for a specific customer, use the Customer Profile Classes window.

Navigation: Receivables –> Customers –> Profile Classes.

In Profile Class window enter the following information.

In Profile class Amount tab enter the following information.

Save your work.

Define Customers:

Define customers and customer site uses to enter transactions and receipts in Receivables. When you enter a new customer, you must enter the customer’s name, profile class and number (if automatic customer numbering is set to No). You can optionally enter customer addresses, contacts, site uses and telephone numbers. You must enter all the components of your chosen Sales Tax Location Flexfield when entering customer addresses in your home country.

Navigation: Receivables –> Customers –> Standard.

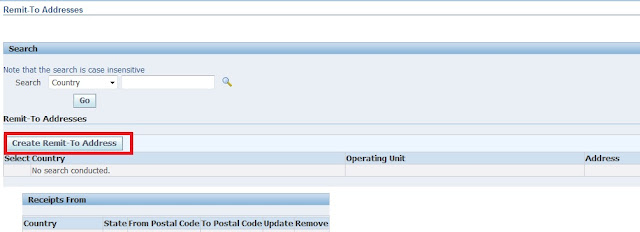

Define Remit–To Addresses:

Define remit–to addresses to inform your customers where to send payments. Associate each remit–to address with one or more state, country, and postal code combinations.

For example, if you want your customers in California and Nevada to send their payments to a specific address, enter the remit–to address and associate the states CA and NV with this address. Remit–to addresses are assigned based on the bill–to address on the transaction.

Navigation: Setup –> Print –> Remit-to-addresses.

Click on Create Remit to addresses.

Enter the required information

Click on Apply.

Enter the country name in the same page and then click on the GO.

Click on the Receipts form Create button.

Enter the following information and click on Apply button.

Now, legal Entities can be mapped to entire Ledgers or if you account for more than one legal entity within a ledger, you can map a legal entity to balancing segments within a ledger.

While a set of books is defined by 3Cs

- chart of accounts

- functional currency

- accounting calendar,

The addition in this list the ledger is defined by a 4th C: the accounting method.

This 4th C allows you to assign and manage a specific accounting method for each ledger. Therefore, when a legal entity is subject to multiple reporting requirements, separate ledgers can be used to record the accounting information.

Accounting Setup Manager is a new feature that allows you to set up your common financial setup components from a central location.

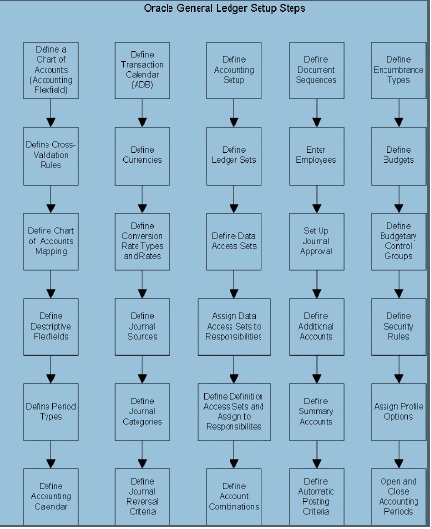

General Ledger Setup Flowchart

While you can set up your Oracle General Ledger application in many different ways, and defer optional set up steps until you are ready to use the corresponding functionality, we recommend you use the order suggested in the following flowchart: Some of the steps outlined in this flowchart and setup checklist are Required and some are Optional. You need to perform Optional steps only if you plan to use the related feature or complete certain business functions.

The following setup steps are a high level overview of the setup steps related to Oracle

General Ledger and Accounting Setup Manager.

5. Assign Balancing Segment Values to respective Legal entities.

- Create legal entity

- Define Leger

Click on Next and then Finish.

- Define Accounting Options

Click on Define Accounting Options and click on update.

Click on Next, and assign Retained earnings Account.

Click on Next, Next, and Finsh.

Assign Legal entities to your Ledger.

Click on Add Legal entity.

Add your Legal entity and click on Apply.

- Assign Balancing segment values to legal entities

Click on the update Balancing Segment Values

Click on Add Balancing Segment Value.

Assign Balancing segment values to these legal entities.

Click on Apply and then click onComplete.

Once you complete ledger we are getting the following Warning.

Click on Yes.

Ofter click on the yes we are getting the following confirmation.

Click on Return to Accounting Setups.

Operating units are assigned to ledgers and a default legal context. Information is secured by operating unit for these applications using responsibilities. Each user can access, process, and report on data only for the operating units assigned to the MO: Operating Unit or MO: Security Profile profile option.

The MO: Operating Unit profile option only provides access to one operating unit.

The MO: Security Profile provides access to multiple operating units from a single responsibility. You can define operating units from the Define Organization window in Oracle HRMS or from Accounting Setup Manager in General Ledger.

For further reference: Visit Google.com and search for “Oracle Multiple Organization Manual”. download the pdf file for detailed information on multiple ORG.

Prerequisites for defining operating unit:

1. Define Location.

2. Define Business Group.

3. Define Ledger.

Navigation: HRMS –> Work Structures –> Organization –> Description.

Click on New.

Type your operating unit name, type ,location and organization classification.

Click on Others.

Select operating unit information.

Enter the Primary Ledger name, Legal entity name and Operating unit short code

– Goods Received Date + Receipt Acceptance Days

– Invoice Date

– Terms Date

Payables populates the Payment Due Date with the most recent date among the above dates.

The logic is:

Most Recent( Goods Received Date + Receipt Acceptance Days, Invoice Date, Terms Date )

Goods Received Date:

Goods Received Date gets populated on the invoice based on Terms Date Basis. We can find Terms Date Basis at following levels.

– Supplier Site Level

– Supplier level

– Payables Options

Payables first looks for Terms Date Basis at Supplier Site Level. If there is no value exist here, it will look at Supplier Level. If there is no value here as well, then Payables takes this value from Payables Options.

Receipt Acceptance Days:

We can find Receipt Acceptance Days under Invoice Tab in Payables Options.

Invoice Date:

We can find the Invoice Date in Invoice Date field on Payables Invoice.

Terms Date:

Terms Date is the beginning date from which Payment Terms start when Payables calculates the scheduled payment(s) for an invoice. The invoice Terms Date defaults based on Terms Date Basis option you select:

• System: System date on day of invoice entry.

• Goods Received: The date you receive goods for invoices you match to purchase orders.

• Invoice: Invoice date.

• Invoice Received: Date you receive an invoice.

Payment Due Date calculation in case of a matched Invoice:

In case of a Matched invoice, Payables consider Receipt Transaction Date along with Goods Received Date + Receipt Acceptance Days, Invoice Date, and Terms Date.

The process includes two steps:

1. The system first checks for recent date of Goods Received Date+Receipt Acceptance Days and Receipt Transaction Date

The logic is:

Recent (GOODS RECEIVED DATE+RECEIPT ACCEPTANCE DAYS, RECEIPT TRANSACTION DATE)

2. After step1, the system uses the following logic again

Recent ( Recent Date from step1, Invoice Date, Terms Date)

Payables consider Receipt Date based on the “Recalculate Scheduled Payment” check box under Invoice Tab in Payables Options. If this check box is enabled, Payables consider the Receipt Date for the calculation of Payment Due Date. If you don’t want the system to use Receipt Date in the calculation of Payment Due Date, then disable “Recalculate Scheduled Payment”.

If you want recalculation, then system considers Receipt date for a matched invoice.

Navigation to enable/disable “Recalculate Scheduled Payment”:

Responsibility: Payables Responsibility which has the access to setups

Tab: Invoice

Latest Posts

- R12 – How to Handle NULL for :$FLEX$.VALUE_SET_NAME In Oracle ERPAugust 25, 2023 - 1:20 pm

- R12 – How to Delete Oracle AR TransactionsMarch 22, 2019 - 8:37 pm

- How to Define Custom Key Flexfield (KFF) in R12January 19, 2018 - 5:43 pm

- AutoLock Box Concepts In R12November 10, 2017 - 8:30 am

- R12 – java.sql.SQLException: Invalid column type in OAFSeptember 15, 2017 - 9:39 am

| S | M | T | W | T | F | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

Recent Comments