This document explains the basic setup needed to setup TDS for suppliers in R12.

1. Pan Number at the Legal Entity level

When Legal Entity is created, enter the Pan Number in the “Pan” field. This field is mandatory for India territory.

2. Attach Inventory Organization in Location

Create the inventory organization and attach it with the location. Only those locations with inventory organization attached will appear in the location field of organization additional information form.

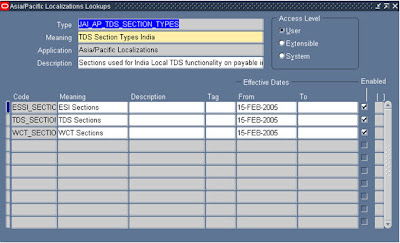

3. TDS Lookups (Seeded values)

We need to make sure that the following seeded values are available in Asis/Pacific Localization lookups.

- JAI_AP_TDS_SECTION_TYPES

- JAI_TDS_SECTION

- JAI_TDS_VENDOR_TYPE

- TDS Vendor type is used for categorizing vendors from TDS perspective.

- TDS Vendor type and TDS section code determines TDS rate and surcharge based on TDS thresholds defined

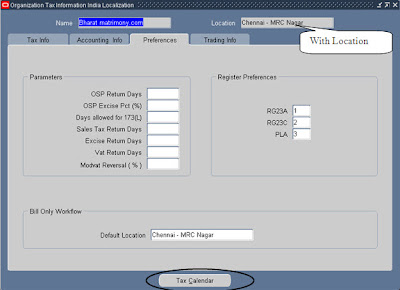

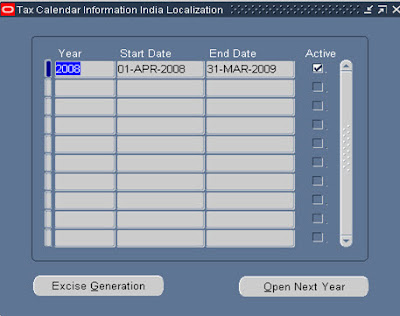

4. Create Organization Additional Information and Tax calendar for the organization

For all inventory organizations, additional localization information needs to be maintained.

- We need to define two records here for each organization, one with location and another without location.

- Excise details are mandatory for manufacturing organization

- For trading organization, excise tab details should not be filled and trading information tab should be entered.

- Pan No, Tan No, Ward No are currently redundant and not used

- Only one tax calendar can be active at a time.

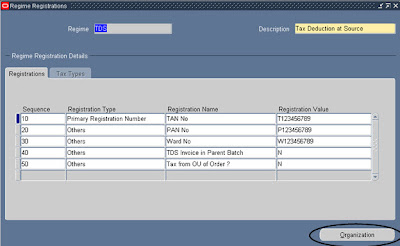

5. Create Regime Registration for TDS

Query the recode with Regime code as TDS. All the details except registration value in the registration tab will be defaulted. Enter appropriate registration value against the registration name. These details would get defaulted for the operating units and can be changed, if required.

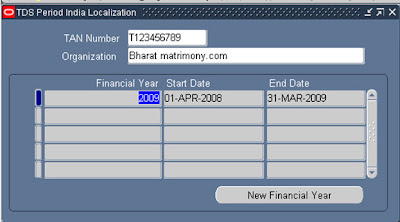

6. Enter TDS Period

We need to enter the TDS period for calculating the TDS amount for the period. TAN number will be available in the LOV only if regime registration is completed for TDS.

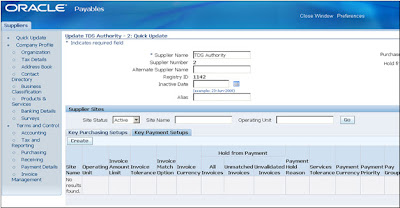

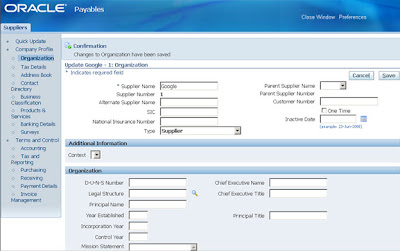

7. Create TDS Authority as Supplier

We need to create a supplier with supplier type as “India TDS Authority”. Enter all the mandatory fields like payment method, payment terms etc.

Other suppliers are entered as usual.

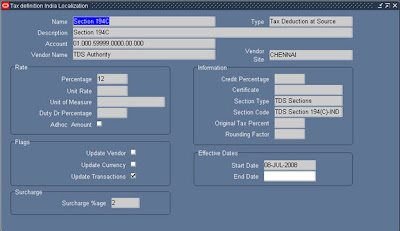

8. Create a Tax definition

We need to create different tax codes for different section codes and tax rates. Enter the basic percentage in the Percentage field and enter additional surcharge details. System will automatically calculate the total percentage. If any lower TDS is involved for certain forms like Form C, enter the certificate name and original tax percent.

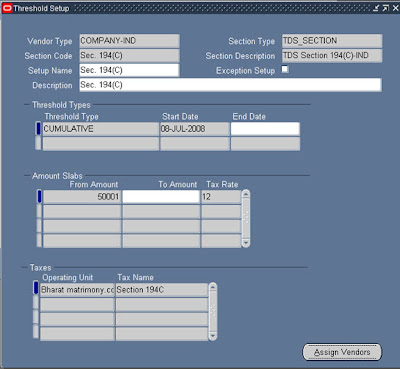

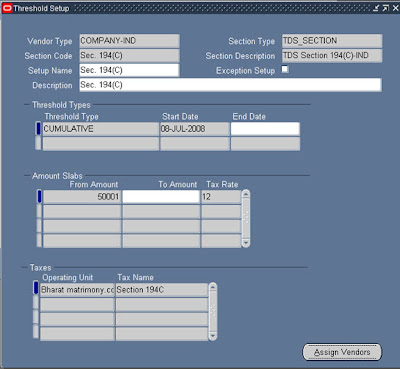

9. Create Threshold Setup

Threshold is defined for each section by TDS vendor type. Thresholds applicable to specific vendors are defined as exception setups and vendors are assigned manually to this setup.

There are two types of Thresholds

- Single – Applicable to a Single transaction

- Cumulative – In this case, TDS is applicable only when the cumulative purchases made from the supplier in one financial year exceeds specified limit i.e, Cumulative threshold amount.

Multiple thresholds with different tax rates may exist. For example, tax rate is 12 percent for the cumulative amount below 10L and tax rate of 12.24 percent for the cumulative amount above 10L.

Before cumulative threshold is reached, single invoice amount greater than the threshold limit for a single invoice attracts TDS at predefined rate

Threshold Amount = Total Invoice Amount – Total Invoice Cancelled Amount – Total Invoice Apply Amount + Total Invoice Unapply Amount

10. Create Supplier Additional Information

We need to add Pan Number, TAN number and TDS Details for each supplier. We should create two records for each supplier, one without supplier site and another with supplier site. Pan number should be confirmed at the supplier level and it can not be modified thereafter.

Enable invoice approval checkbox, if TDS invoice created for the supplier should be in approved status.

Enter the default TDS Section and/or Tax name, if TDS tax code should be automatically defaulted in the invoice for this supplier. Tax code defaulting logic is given below.

If default section and default tax name are not given in the supplier additional information and if tax name is not manually entered in the invoice, then TDS will not be calculated and no TDS invoice will be generated.

11. Review and Complete DFF and Profile Settings

TDS tax code is now captured in Global Descriptive Flexfield in the invoice distribution screen. We need to make sure that the DFF JG_AP_INVOICE_DISRIBUTIONS is enabled.

Also define the following profile option values at the responsibility level

|

Profile Options

|

Values

|

|

JG: Application

|

Payables

|

|

JG: Product

|

Asia Pacific Localization

|

|

JG: Territory

|

India

|

The country used against the Legal entity / Operating unit has to be India

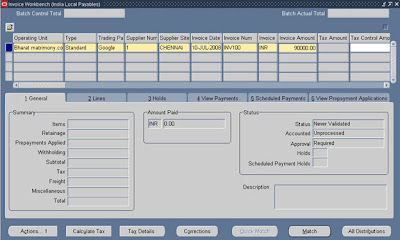

Invoice Transaction

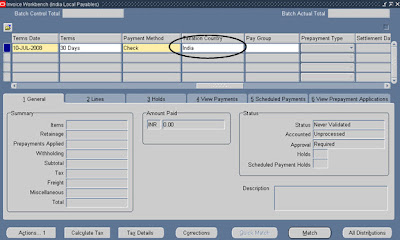

Let us now create an invoice for the “Google” supplier.

Invoice Amount – 90000

TDS Tax rate – 12% if the invoice amount is above 50001

Hence the TDS Invoice amount will be 90000 * 0.12 = 10800

Make sure that the taxation country is defaulted as ‘India’

As soon as the invoice distribution details are saved, the tax code ID is defaulted in DFF as shown below. The user can change the tax code, if required.

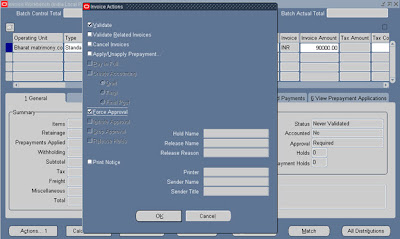

When the invoice is validated, system will run a concurrent program which will create TDS invoice (Credit Memo) for the supplier and another standard invoice for the TDS authority.

Click on ‘View Output’ for ‘Import TDS Invoices’ concurrent program to check for any errors. The report shows all the imported and error lines.

The invoice number format for the credit memo for the supplier and standard invoice for the TDS authority is given below

Supplier Credit Memo: (Original Invoice Number)-TDS-CM-(Serial Number)

Invoice for TDS Authority: (Original Invoice Number)-TDS-SI-(Serial Number)

References

- Oracle Financials for India – Implementation Guide

- Oracle Metalink Docs

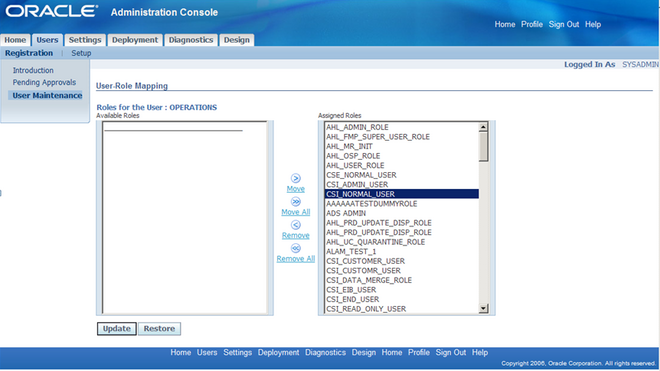

All All the functionalities of installed base module can be accessed with Installed Base User responsibility. And to access the’ Installed Base User’ responsibility’ the user must be assigned to CSI_NORMAL_USER role.

All All the functionalities of installed base module can be accessed with Installed Base User responsibility. And to access the’ Installed Base User’ responsibility’ the user must be assigned to CSI_NORMAL_USER role.

Recent Comments