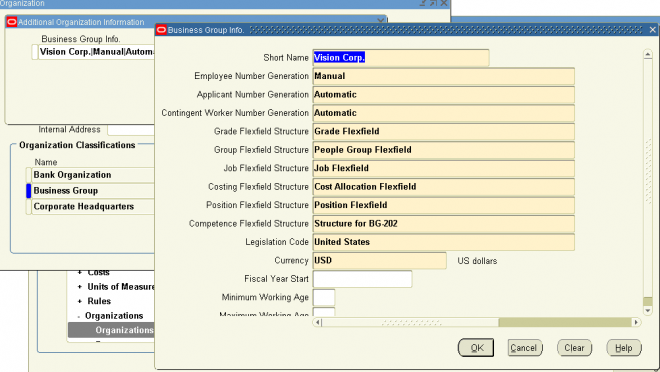

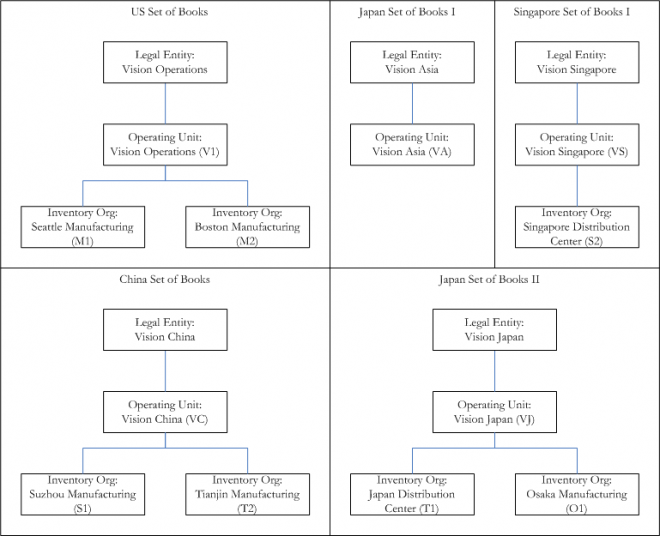

i. Business group

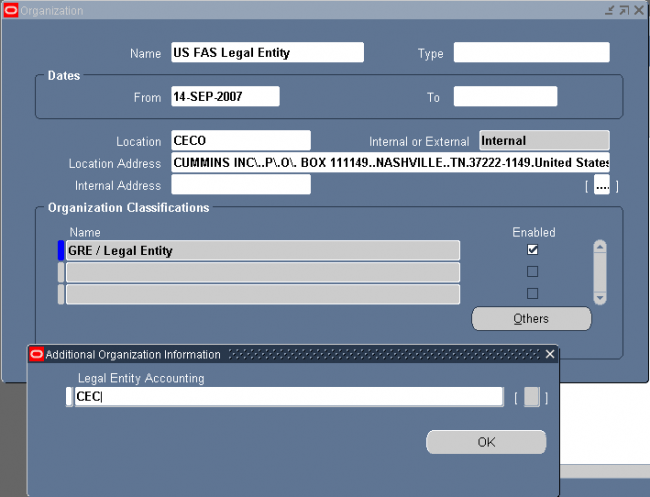

ii. Legal Entity

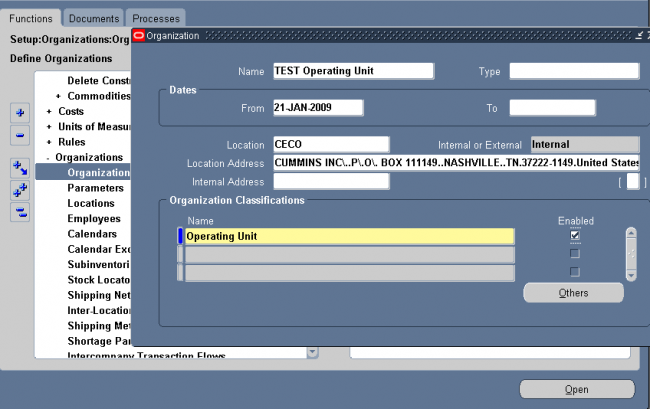

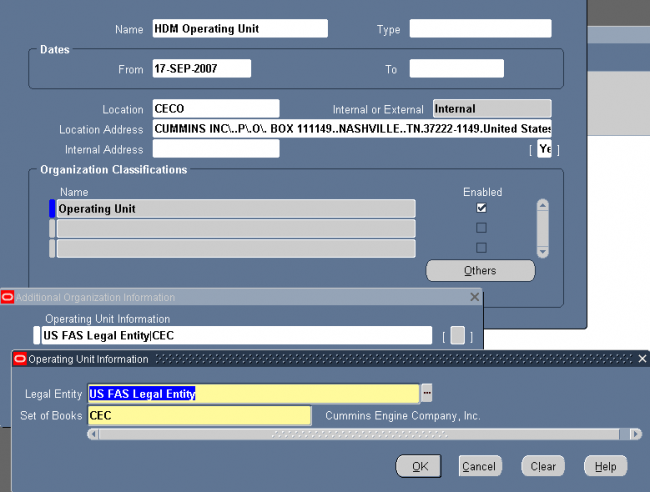

iii. Operating Units

iv. Organization

Internal organizations (for example, departments, sections or cost centers)

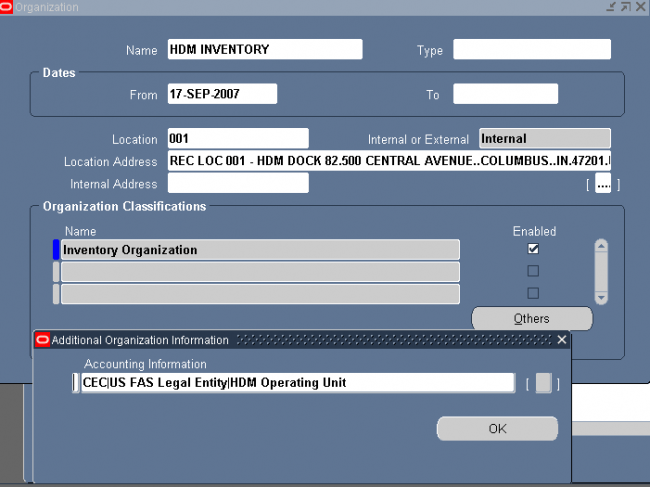

1. Enter a name for your organization in the Name field. A check is performed to see if organizations with the same name already exist.

All Oracle applications you install share the information entered in the Organization window. Therefore organization names must be unique within a business group, and business group names must be unique across your applications network.

You can create two organizations with the same name in different business groups but this can cause confusion later, if the HR: Cross business group profile option is set to Yes and you decide to share certain information across all business groups. If you decide to create two organizations with the same name, be sure that this will not cause you problems in the future.

Organization types do not classify your organization, you use them for reporting purposes only. The type may identify the function an organization performs, such as Administration or Service, or the level of each organization in your enterprise, such as Division, Department or Cost Center.

Note: You cannot assign an employee to an organization before the start date of the organization.

If you are using Oracle Payroll in the US, every organization to which employees can have assignments, including business groups, must have on record a location with a complete address. This is because the system uses the location of the organization of the employee’s primary assignment to determine employee work locations for tax purposes. This does not apply to GREs, because the assignment to a GRE exists in addition to the assignment to an organization.

For Dutch users only, if you are setting up external organizations for a tax office, a social insurance provider or a private health insurance provider, you must enter the postal address and contact details using the NL_POSTAL_ADDRESS Location EIT.

Note: If you are an Oracle Inventory user, then you must not assign a location to more than one organization classified as an Inventory Organization.

Examples of external organizations that may require entry are disability organizations, benefits carriers, insurance carriers, organizations that employees name as beneficiaries of certain employee benefits, and organizations that are recipients of third party payments from employees’ pay.

1. Business Group

Budget Value Defaults.

Work Day Information.

Benefits Defaults.

PTO Balance Type.

Recruitment Information.

Payslip Information.

Self Service Preference Information.

Recent Comments