User can able to delete the AR transaction in below cases are met:

- The invoice in the incomplete status.

- The invoice doesn’t posted.

- This is no receipt applied to the invoice.

Note:

- You might miss your invoice document sequence.

- Based on company policy, whether you can keep the document or remove from system.

If the Invoice in ‘complete‘ status, create a Credit Memo against this invoice and nullify the transaction.

AR invoice transaction using this package ‘ar_invoice_api_pub.delete_transaction’ in R12

Step 1: Incomplete the invoice.

— For R12 ——

–AR_TRANSACTION_GRP.INCOMPLETE_TRANSACTION

SET SERVEROUTPUT ON;

DECLARE

l_return_status VARCHAR2 (100);

l_message_count NUMBER;

l_message_data VARCHAR2 (1000);

lv_error_message VARCHAR2 (800);

BEGIN

mo_global.set_policy_context ('S', 800);

fnd_global.apps_initialize(0,51234,222);

ar_transaction_grp.incomplete_transaction

(p_api_version => '1.0',

p_init_msg_list => fnd_api.g_true,

p_commit => fnd_api.g_false,

p_validation_level => fnd_api.g_valid_level_none,

p_customer_trx_id => 198364532,

x_return_status => l_return_status,

x_msg_count => l_message_count,

x_msg_data => l_message_data

);

COMMIT;

IF l_return_status IN ('E', 'U')

THEN

FOR i IN 1 .. l_message_count

LOOP

lv_error_message :=

lv_error_message || '--' || fnd_msg_pub.get (i, 'F');

DBMS_OUTPUT.put_line ('l_return_status- ' || l_return_status);

END LOOP;

DBMS_OUTPUT.put_line ( 'API Failed. Error:'

|| SUBSTR (lv_error_message, 1, 800)

);

ELSE

DBMS_OUTPUT.put_line ('AR Invoice Incompleted successfully');

DBMS_OUTPUT.put_line ('lv_return_status-' || l_return_status);

END IF;

END ;

Step 2: Check the following Prerequisites:

- Check if ‘Allow Transaction Deletion’ flag is Yes, If “No”, check the flag for respective operating unit.

Navigation : Receivables -> Setup -> System -> System Options

>> Query for respective operating unit

>> Click on ‘Trans and Customers’ Tab > Check for ‘Allow Transaction Deletion’ flag. - Transaction Should be incomplete.

- There should be no activity against the transaction like it must neither be applied, printed or posted to GL etc.

Step 3: Sample script for invoice deletion

------------------- Create Custom Table ---- For your Deleting Data Set --------------

CREATE TABLE OEAG.XXERP_AR_DELETE_TRANS

AS

SELECT CUSTOMER_TRX_ID,

TRX_DATE,

TRX_NUMBER,

BILL_TO_CUSTOMER_ID,

BILL_TO_SITE_USE_ID,

ORG_ID,

CREATION_DATE,

CREATED_BY,

'N' V_RET_STATUS,

'N' V_MSG_COUNT,

'N' V_MSG_DATA,

'N' V_MESSAGE_TBL

FROM RA_CUSTOMER_TRX_ALL

WHERE ORG_ID = 800

AND CUST_TRX_TYPE_ID = 1265

AND TRX_DATE = '20-MAR-2019';

---------------- START --- AR INVOICE DATA DELETE PROGRAM ---------------------

SET SERVEROUTPUT ON;

DECLARE

CURSOR cur_all_trx

IS

SELECT ROWID,

NULL PARTY_NUMBER,

RCT.ORG_ID,

RCT.CUSTOMER_TRX_ID,

RCT.TRX_NUMBER

FROM OEAG.XXERP_AR_DELETE_TRANS RCT

WHERE NVL (V_RET_STATUS, 0) <> 'S'

AND TRX_NUMBER = '900918263';

xv_msg_data VARCHAR2 (4000) := NULL;

xv_msg_count NUMBER := 0;

v_msg_index NUMBER := 0;

xv_ret_status VARCHAR2 (1) := NULL;

v_message_tbl arp_trx_validate.message_tbl_type;

v_res VARCHAR2 (4000) := NULL;

v_res_name VARCHAR2 (4000) := NULL;

v_app VARCHAR2 (4000) := NULL;

v_user NUMBER := 1110;

BEGIN

DBMS_OUTPUT.put_line ('Detele Transaction...');

FOR c_rec IN cur_all_trx

LOOP

DBMS_OUTPUT.put_line (' Transaction No.: ' || c_rec.trx_number);

DBMS_OUTPUT.put_line (' Transaction ID : ' || c_rec.customer_trx_id);

DBMS_OUTPUT.put_line (' Org ID : ' || c_rec.org_id);

----------------------------------------------------------------------------

---- Setting the org context for the particular session

apps.mo_global.set_policy_context ('S', c_rec.org_id);

-- apps.mo_global.init('AR');

SELECT application_id, responsibility_id

INTO v_app, v_res

FROM fnd_responsibility_tl

WHERE responsibility_id = 51234;

---- Setting the oracle applications context for the particular session

apps.fnd_global.apps_initialize (v_user, v_res, v_app);

----------------------------------------------------------------------------

xv_ret_status := NULL;

xv_msg_count := NULL;

xv_msg_data := NULL;

--update the Allow Transaction Deletion to Yes to Delete (As mentioned above, better to do it from application)

UPDATE ar_system_parameters_all

SET invoice_deletion_flag = 'Y'

WHERE org_id = c_rec.org_id;

ar_invoice_api_pub.delete_transaction (

p_api_name => 'Delete_Transaction',

p_api_version => 1.0,

p_init_msg_list => fnd_api.g_true,

p_commit => fnd_api.g_true,

p_validation_level => fnd_api.g_valid_level_full,

p_customer_trx_id => c_rec.customer_trx_id,

p_return_status => xv_ret_status,

p_msg_count => xv_msg_count,

p_msg_data => xv_msg_data,

p_errors => v_message_tbl);

UPDATE OEAG.XXERP_AR_DELETE_TRANS

SET v_ret_status = xv_ret_status

WHERE ROWID = c_rec.ROWID;

UPDATE OEAG.XXERP_AR_DELETE_TRANS

SET v_msg_count = xv_msg_count

WHERE ROWID = c_rec.ROWID;

IF xv_ret_status <> 'S'

THEN

DBMS_OUTPUT.put_line (' Status: ' || xv_ret_status);

UPDATE OEAG.XXERP_AR_DELETE_TRANS

SET v_msg_data = v_ret_status

WHERE ROWID = c_rec.ROWID;

FOR i IN 1 .. xv_msg_count

LOOP

apps.fnd_msg_pub.get (i,

apps.fnd_api.g_false,

xv_msg_data,

v_msg_index);

DBMS_OUTPUT.put_line (' Error : ' || xv_msg_data);

END LOOP;

DBMS_OUTPUT.put_line (' ' || xv_msg_data);

ELSE

DBMS_OUTPUT.put_line (' Deleted.');

-- Revert back to the original value for the deletion flag

UPDATE ar_system_parameters_all

SET invoice_deletion_flag = 'N'

WHERE org_id = c_rec.org_id;

END IF;

DBMS_OUTPUT.put_line ('--------------------');

COMMIT;

END LOOP;

EXCEPTION

WHEN OTHERS

THEN

DBMS_OUTPUT.put_line ('Error : ' || SQLERRM);

END;

/

Note: User can able to delete the transaction front end also, after completing Step 2.

R12 – How to Handle NULL for :$FLEX$.VALUE_SET_NAME In Oracle ERP

:$FLEX$.VALUE_SET_NAME to set up value sets where one segment depends on a prior segment that itself depends on a prior segment (“cascading dependencies”)

Share this:

R12 – How to Delete Oracle AR Transactions

User can able to delete the AR transaction in below cases are met:

Note:

If the Invoice in ‘complete‘ status, create a Credit Memo against this invoice and nullify the transaction.

AR invoice transaction using this package ‘ar_invoice_api_pub.delete_transaction’ in R12

Step 1: Incomplete the invoice.

— For R12 ——

–AR_TRANSACTION_GRP.INCOMPLETE_TRANSACTION

Step 2: Check the following Prerequisites:

Navigation : Receivables -> Setup -> System -> System Options

>> Query for respective operating unit

>> Click on ‘Trans and Customers’ Tab > Check for ‘Allow Transaction Deletion’ flag.

Step 3: Sample script for invoice deletion

Note: User can able to delete the transaction front end also, after completing Step 2.

Share this:

How to Define Custom Key Flexfield (KFF) in R12

I will explain how to create a custom KFF. Here I’m using XXCUST_KFF_DEMO table to capture the KFF code combinations.

Following steps needs to perform to create custom KFF.

1) Register the XXCUST_KFF_DEMO table.

Click here to see the code.

Verify the table has created successfully.

Navigation: Application Developer > Application > Database > Table

2) Register the Key Flexfield.

Navigation : Application Developer > Flexfield > Key Flexfields

3) Define the structure and segments.

Navigation: Application Developer > Flexfield > Key Flexfield Segments

Click on Segments button.

Save the created Information.Check the Allow Dynamic Inserts check box if you want to create the combination from the KFF display window. Once you complete all the changes, check the Freeze Flexfield Definition check box.

4) Create a sequence XXCUST_KFF_DEMO_S.

5) create KFF item through OAF Page.

Here I am using a page based on table XXCUST_KFF_TRN.

You can see the output below.

Learn how to use Custom Flexfields in Oracle Forms here.

Share this:

AutoLock Box Concepts In R12

AutoLockbox Is A Service That Commercial Banks Offer Corporate Customers To Enable Them To Outsource Their Accounts Receivable Payment Processing. It eliminates Manual Data Entry By Automatically Processing Receipts That Are Sent Directly To Your Bank. You Can Also Use AutoLockbox for Historical Data Conversion.

For Example, You Can Use AutoLockbox To Transfer Receipts From Your Previous Accounting System Into Receivables.

AutoLockbox Ensures That The Receipts Are Accurate And Valid Before Transferring Them Into Receivables.

AutoLockbox Is A Three Step Process:

These steps can be submitted individually or at the same time from the submit Lockbox Processing window.

Responsibility: Receivables Manager

Navigation: Interfaces > Lockbox

After you run Post QuickCash, Receivables treats the receipts like any other receipts, you can reverse and reapply them and apply any unapplied, unidentified, or on-account amounts.

Importing Data From The Data File Provided By Bank:

Setups:

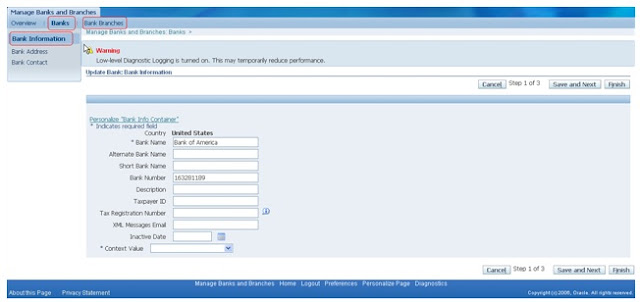

Define Bank And Bank Branches

Define Internal Remittance Bank And Bank Branch Where Checks From Customer Are Deposited. This Is The Bank Which Sends The Data File For Lockbox Transmission.

Responsibility: Cash Management Manager

Navigation: Setup > Banks > Banks.

Remittance Bank Account

Define Internal Bank Account.

Responsibility: Cash Management Manager

Navigation: Setup > Banks > Bank Accounts

2.Enter the Bank Account Information

3. Enter Account Controls. A Cash Account is required

4.Enter Account Access and Contacts as required

Define Receipt Classes

Define Receipt classes to determine the required processing steps for receipts to which you assign payment methods with this class.

Enter the Payment Method to assign to this receipt class.

Responsibility: Receivables Manager

Navigation: Setup > Receipts > Receipt Classes

Assign Bank Account To Payment Method

Receivables uses payment methods to account for the receipt entries. One can assign multiple banks to each payment method, but only one bank account can be primary account for each currency.

Assign the payment method to the customer against whose invoice the receipt is going to be applied to.

Responsibility: Receivables Manager

Navigation: Setup > Receipts > Receipt Classes

Define Receipt Source

Define receipt batch sources and assign the receipt class, payment method, and remittance bank account fields to this source.

Responsibility: Receivables Manager

Navigation: Setup > Receipts > Receipt Sources

Define Lockbox

Bank Tab

Responsibility: Receivables Manager

Navigation: Setup > Receipts > Lockboxes > Lockboxes > Bank Tab

Define Lockboxes to use the Receivables Autolockbox program

contact person, and accounting flexfield information associated with this batch source.

Receipts Tab

Responsibility: Receivables Manager

Navigation: Setup > Receipts > Lockboxes > Lockboxes > Receipts Tab

choose Constant Date, Receivables does not validate your data. If you choose this source and the lockbox transmission’s deposit date is not

defined, Receivables displays an error message indicating that you must define

a deposit date to submit the lockbox.

Choose a Match Receipts By method. (If Autoassociate is set to Yes)

Lockbox uses the balance forward billing number to identify the customer. Post QuickCash then uses this customer’s AutoCash Rule Set to determine how to apply the receipt to each invoice.

This is a custom matching method that you define. Lockbox uses this number to determine the corresponding invoice number.

Choose whether to Match on Corresponding Date for transactions in this Lockbox transmission.

Transactions Tab

Responsibility: Receivables Manager

Navigation: Setup > Receipts > Lockboxes > Lockboxes > Transactions Tab

lines.

A remittance line’s eligibility for claim creation depends on your system options setup.

If you select this box but the remittance line is not eligible for claim creation, then Lockbox handles receipts according to the selection that you make in the next step.

You need to edit the invalid record(s) in the Lockbox Transmission Data window, then resubmit the Validation step for the receipt before Lockbox can import it into Receivables interim tables.

None is the default line level cash application option for new setups and migrated data.

Define Transmission Format

Define the Transmission Format which Auto Lockbox uses when importing data into Receivables.

Responsibility: Receivables Manager

Navigation: Setup > Receipts > Lockboxes > Transmission Formats

Following are valid record types:

Batch Headers usually contain information such as batch number, deposit date, and lockbox number.

Batch Trailers usually contain information such as batch number, lockbox number, batch record count, and batch amount.

Lockbox Headers usually contain information such as destination account and origination number.

Lockbox Trailers usually contain information such as lockbox number, deposit date, lockbox amount, and lockbox record count.

Receivables combines the overflow and payment records to create a logical record to submit payment applications.

Transmission Headers usually contain information such as destination account, origination number, deposit date, and deposit time.

Transmission Trailers usually contain information such as total record count.

Define Transmission Fields

Setting Up Transmission Fields

Responsibility: Receivables Manager

Navigation: Setup > Receipts > Lockboxes > Transmission Formats

Select a record type , click on Transmission Fields.

The transmission format must be fully compatible with how you organize data in your lockbox file.

These positions determine how Receivables identifies the starting and ending position of your field type when you import data from your bank file.

This field is required when Field Type is either Deposit Date or Receipt Date.

If you enter Yes, Receivables will round the amount to the same degree of precision and the same number of decimal places as your functional currency format.

For example, if your functional currency is USD (precision = 2) and you set this option to Yes, a value of 50000 in the bank’s data file will be formatted as 500.00; otherwise, this value will not be formatted and will appear as 50000.

This field is required when your Field Type is Amount Applied 1-8, Batch Amount, Lockbox Amount, Remittance Amount, or Transmission Amount.

Valid Field Types

When defining your transmission fields, you can choose from the following field types:

The bank account number and the transit routing number make up your customer’s MICR number.

Each payment or overflow payment record can accommodate up to eight debit item numbers. For cross currency applications, this is the amount to apply in the transaction currency and corresponds to the Amount Applied field in the Applications window.

Each payment or overflow payment record can accommodate up to eight debit item numbers. This field corresponds to the Allocated Receipt Amount field in the Applications window.

Attributes can only be assigned to Payment records, and they become the Descriptive Flexfield data in the QuickCash, Receipts, and Applications windows.

The total number of all batch record counts equals the Lockbox Record Count. This does not include overflow payments, headers, or trailers.

You must only specify the field name and the field positions that the billing location occupies in the transmitted data file.

Each payment or overflow payment record can accommodate up to eight debit item numbers.

This field is used for cross currency receipt applications when the receipt and transaction currencies do not have a fixed exchange rate (the euro and all NCUs have fixed exchange rates with each other). If the currencies have a fixed rate, this field is optional (AutoLockbox derives the rate to use in this case).

The transit routing number and the customer bank account number make up your customer’s MICR number.

Define AutoCash Rule Sets

Define AutoCash Rule Sets to determine the sequence of rules that Post QuickCash uses to update Customers account balances.

Responsibility: Receivables Manager

Navigation: Setup > Receipts > AutoCash Rule Sets

Open Balance Calculation

You negotiate earned discount percentages when you define specific receipt terms. You can enter this option if Allow Unearned Discounts is set to Yes in the System Options window. In this case, Receivables only allows earned discounts for this AutoCash Rule Set.

You cannot choose this option if the system option Unearned Discounts is set to No.

Automatic Matching Rule

Define the Automatic Matching Rule for this AutoCash Rule set.

A partial receipt is one in which the receipt minus the applicable discount does not close the debit item to which this receipt is applied.

The applicable discount that Receivables uses for this rule depends upon the value you entered in the Discounts field for this AutoCash Rule Set. If you exclude late charges (by setting Finance Charges to No) and the amount of your receipt is equal to the amount of the debit item to which you are applying this receipt minus the late charges, Receivables defines this receipt as a partial receipt. In this case, Receivables does not close the debit item because the late charges for this debit item are still outstanding.

If Apply Partial Receipts is set to No, this AutoCash Rule Set will not apply partial receipts and will either mark the remaining receipt amount ‘Unapplied’ or place it on-account, depending on the value you entered in the Remaining Remittance Amount field.

AutoCash Rules

This rule uses the transaction due date when determining which transaction to apply to first. This rule uses the values you specified for this AutoCash Rule Set’s open balance calculation to determine your customer’s oldest outstanding debit item. Post QuickCash uses the next rule in the set if any of the following are true:

This rule marks any remaining receipt amount ‘Unapplied’ or places it on-account, depending on the value you entered in the Remaining Remittance Amount field for

this AutoCash Rule set .

exactly match this customer’s account balance, Post QuickCash uses the next rule in the set. This rule calculates your customer’s account balance by using the values

you specified for this AutoCash Rule Set’s open balance calculation and the number of Discount Grace Days in this customer’s profile class. This rule also includes all of this customer’s debit and credit items when calculating their account balance. This rule ignores the value of the Apply Partial Receipts option.

This AutoCash Rule uses the following equation to calculate the open balance for each debit item:Open Balance = Original Balance + Late Charges – Discount

Receivables then adds the balance for each debit item to determine the customer’s total account balance. The ‘Clear the Account’ rule uses this equation for each invoice, chargeback, debit memo, credit memo, and application of an Unapplied or On-Account receipt to a debit item.

A debit item is considered past due if its due date is earlier than the receipt deposit date. This rule considers credit items (i.e. any pre-existing, unapplied receipt or credit memo) to be past due if the deposit date of the receipt is either the same as or later than the deposit date of this pre-existing receipt or credit memo. In this case, this rule uses a pre-existing receipt or credit memo before the current receipt for your AutoCash receipt applications.

If this AutoCash Rule Set’s open balance calculation does not include late charges or disputed items, and this customer has past due items that are in dispute or items with balances that include late charges, this rule will not close these items. This rule ignores the value of the Apply Partial Receipts option.

A debit item is considered past due if the invoice due date is earlier than the deposit date of the receipt you are applying. For credit memos, Receivables uses the credit memo date to determine whether to include these amounts in the customer’s account balance.

Credit memos do not have payment terms, so they are included in each group.

amount. This rule uses the values that you enter for this AutoCash Rule Set’s open balance calculation to determine the remaining amount due of this customer’s debit items. For example, if Finance Charges is No for this rule set and the amount of this receipt is equal to the amount due for a debit item minus its late charges, this rule applies the receipt to that debit item.

If this rule cannot find a debit item that matches the receipt amount, Post QuickCash looks at the next rule in the set. This rule ignores the value of the Apply Partial Receipts option.

Sample Control File

LOAD DATA

APPEND

— Type 4 – Lockbox Header

WHEN RECORD_TYPE = ‘1’

(STATUS CONSTANT ‘AR_PLB_NEW_RECORD’,

RECORD_TYPE POSITION(01:01) CHAR,

LOCKBOX_NUMBER POSITION(02:09) CHAR,

DEPOSIT_DATE POSITION(11:21) DATE ‘DD-MON-YYYY’

NULLIF DEPOSIT_DATE=BLANKS,

DESTINATION_ACCOUNT POSITION(23:47) CHAR,

ORIGINATION POSITION(49:58) CHAR )— Type 2 – Receipt

INTO TABLE AR_PAYMENTS_INTERFACE

WHEN RECORD_TYPE = ‘2’

(STATUS CONSTANT ‘AR_PLB_NEW_RECORD’,

RECORD_TYPE POSITION(01:01) CHAR,

ITEM_NUMBER POSITION(03:06) CHAR,

REMITTANCE_AMOUNT POSITION(08:17) CHAR,

TRANSIT_ROUTING_NUMBER POSITION(18:26) CHAR,

ACCOUNT POSITION(28:37) CHAR,

CHECK_NUMBER POSITION(39:46) CHAR,

CURRENCY_CODE POSITION(48:50) CHAR,

EXCHANGE_RATE POSITION(53:61) CHAR,

CUSTOMER_NUMBER POSITION(63:76) CHAR,

RECEIPT_DATE POSITION(78:88) DATE ‘DD-MON-YYYY’

NULLIF RECEIPT_DATE=BLANKS,

INVOICE1 POSITION(90:109) CHAR,

MATCHING1_DATE POSITION(111:121) DATE ‘DD-MON-YYYY’

NULLIF MATCHING1_DATE=BLANKS,

AMOUNT_APPLIED1 POSITION(123:138) CHAR,

INVOICE2 POSITION(140:159) CHAR,

MATCHING2_DATE POSITION(161:171) DATE ‘DD-MON-YYYY’

NULLIF MATCHING2_DATE=BLANKS,

AMOUNT_APPLIED2 POSITION(173:188) CHAR,

LOCKBOX_NUMBER POSITION(190:196) CHAR

)

— Type 3 – Overflow Receipt

INTO TABLE AR_PAYMENTS_INTERFACE

WHEN RECORD_TYPE = ‘3’

(STATUS CONSTANT ‘AR_PLB_NEW_RECORD’,

RECORD_TYPE POSITION(01:01) CHAR,

ITEM_NUMBER POSITION(03:05) CHAR,

OVERFLOW_SEQUENCE POSITION(07:08) CHAR,

OVERFLOW_INDICATOR POSITION(10:10) CHAR,

INVOICE3 POSITION(12:31) CHAR,

MATCHING3_DATE POSITION(33:43) DATE ‘DD-MON-YYYY’

NULLIF MATCHING3_DATE=BLANKS,

AMOUNT_APPLIED3 POSITION(45:59) CHAR,

INVOICE4 POSITION(61:80) CHAR,

MATCHING4_DATE POSITION(82:92) DATE ‘DD-MON-YYYY’

NULLIF MATCHING4_DATE=BLANKS,

AMOUNT_APPLIED4 POSITION(94:108) CHAR,

LOCKBOX_NUMBER POSITION(110:117) CHAR

)

Sample Data File

1JMARTINE 08-NOV-2011 1632811897361982730000000 0000000287

20001 0000001000736198273 0000000000 PAYMENT1 USD 000000000 00000000001007 08-NOV-2011

3 0001 01 9 123 08-NOV-2011 JMARTINE

Running Lockbox

Responsibility: Receivables Manager

Navigation: Interfaces > Lockbox

Import

If you are resubmitting an existing lockbox transmission, you can select a name from the list of values.

The default value is None.

Validation

You must enter a lockbox number if Submit Validation is Yes and the lockbox number is not specified in your bank file.

Enter Rejects Only to include only records that failed validation.

If you do not check this check box, Receivables will transfer any receipts within a batch that pass validation, even if others are rejected.

If the Reject Entire Receipt box is checked and AutoLockbox encounters an invalid transaction number, the receipt that Lockbox cannot fully apply will remain in the

AR_PAYMENTS_INTERFACE_ALL table. In this case, you need to edit the invalid record(s) in the Lockbox Transmission Data window, then submit the Validation step again for the receipt.

Post Quick Cash:

Save your work. Receivables displays the Request ID of your concurrent process and generates the Lockbox Execution report.

Maintain Transmission Data

Responsibility: Receivables Manager

Navigation: Receipts > Lockbox > Maintain Transmission Data

Use the Lockbox Transmission Data window to delete and edit transmission data imported into Receivables from your bank using Lockbox.

You can correct your lockbox data in this window for receipts that fail validation, then resubmit the validation step to import these receipts.

Use the Lockbox Execution report to help you determine which transmission records you need to correct to ensure that your validation processes succeed.

If you are updating information, be sure to update only those fields that have data corresponding to the transmission format used to submit the import process.

You can customize the appearance of this window by selecting options from the Folder menu. For example, you may choose to add the Alternate Name and Customer Name fields to your default folder.

You can change the values of fields that are included in your transmission format.

Select the Cross Currency Data region to review information about cross

currency receipts

Share this:

R12 – java.sql.SQLException: Invalid column type in OAF

Issue:

When we are using view object (VO) in OA Framework it’s possible that you will run in to the problem java.sql.SQLException: Invalid column type, especially if it’s an LOV VO. When you click on the LOV torch for the first time it is working fine. But whenever when we click on the GO button in the LOV Region it gives an error.

Solution:

What we need to is, change the Binding Style from Oracle Named to Oracle Positional in the View Object declaration. The framework is adding a where clause to the query using bind variables that are typed :n, this is why you need to set Oracle Positional. Now save it run again, then it will solve this issue.

Share this: